[Note on Brand Evolution] This post discusses concepts and methodologies initially developed under the scientific rigor of Shaolin Data Science. All services and executive engagements are now delivered exclusively by Shaolin Data Services, ensuring strategic clarity and commercial application.

Forecasting and scenario planning are similar but different. Specifically, scenario planning is a proper subset of forecasting (Koehler & Harvey, 2004, pp. 274–296). Then, making predictions about unknown items defines forecasting. Forecasting encompasses the weather, where the exact conditions for a location at a given time are largely unknown, and the financial markets, where the future prices and conditions are unknown.

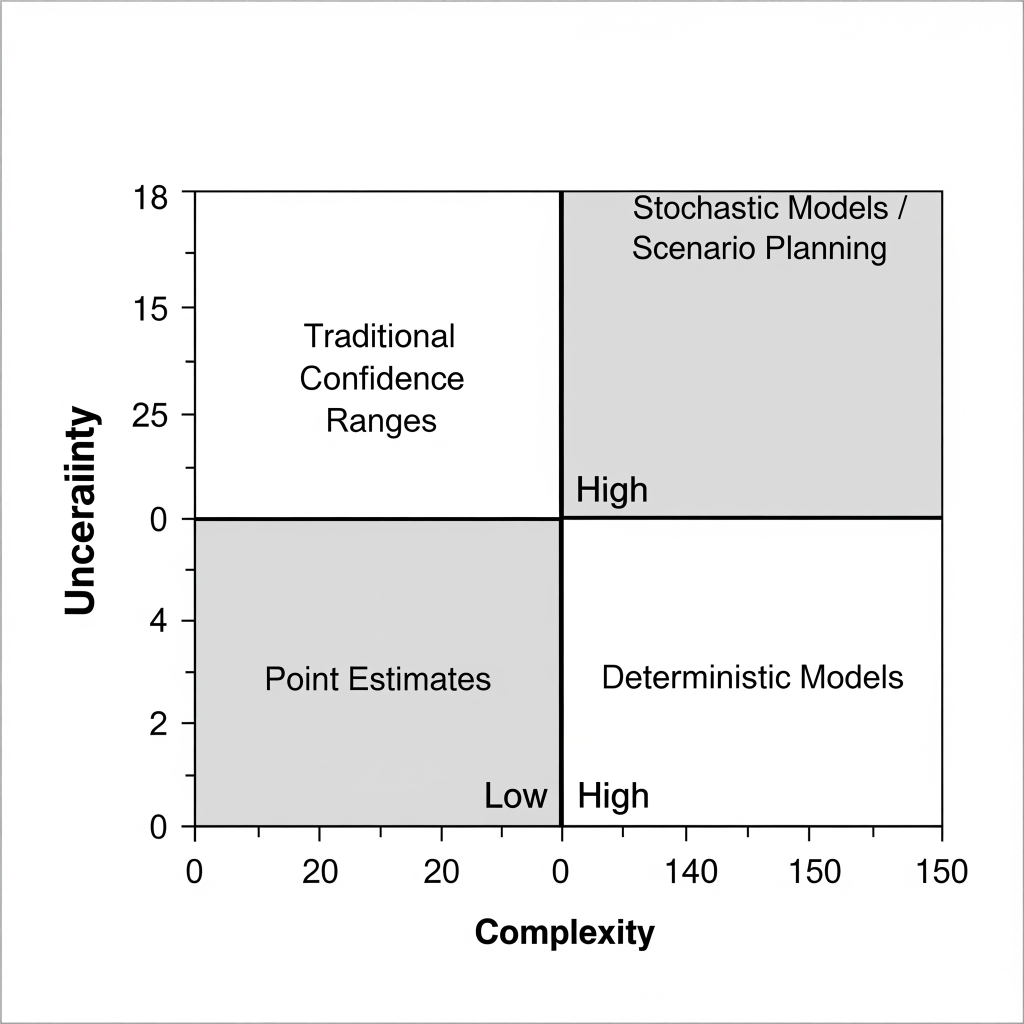

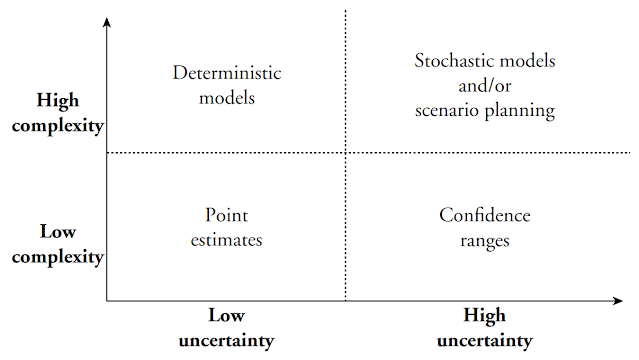

To understand the topology of forecasting, consider the relationship between uncertainty and complexity. Specifically, consider the predictive uncertainty in contrast to the complexity of the topic of interest. Then, complexity describes the number of features associated with the given topic, and uncertainty describes the available knowledge about a specific variable (Koehler & Harvey, 2004, pp. 274–296). In this case, complexity also describes the interrelationships between the features and the extent to which these interrelationships exist. Then, it is easy to misinterpret unacknowledged aspects of complexity as uncertainty. Therefore, point estimates are appropriate for forecasts with low uncertainty and complexity. Deterministic models are suitable for forecasts with high complexity but low uncertainty. Traditional confidence ranges are appropriate for forecasts with low complexity but high uncertainty. Thus, stochastic models or scenario planning are suitable for highly uncertain and complex forecasts.

Figure 1

For brevity, focus on highly uncertain and complex forecasts. These types mandate analyses that explicitly include uncertainty. Specifically, stochastic models, such as queuing models with random arrival times, have this characteristic (Koehler & Harvey, 2004, pp. 274–296). The crucial observation here is that very few models accurately describe global economics due to the challenge of capturing both the complexity and uncertainty elements. Scenario planning proposes a balance between discipline and open-mindedness and offers a compromise between formal models and informal conjecture (Koehler & Harvey, 2004, pp. 274–296). Thus, scenario planning excels as a vector to more concretely understand the impactful forces and allows multiple viewpoint generation for describing the range of complexity and uncertainty.

For all of its virtues, scenario planning typically finds the most frequent use in organizational contexts with big-picture issues and different perspectives about the future. The scenarios in scenario planning emphasize the combined effects of multiple features, whereas the planning aspect aims at understanding the behavior and movement of distinct features or distinct groups of features. Specifically, exploring the feature interactions reveals correlated elements of impact and likelihood (Koehler & Harvey, 2004, pp. 274–296). For instance, trade deficits suggest recessions, urging unemployment indicative of decremented domestic production.

The scenario planning process requires categorizing known and unknown information to begin. The categorized known information provides the basis for trend analysis, illuminating the continuity of forward projections. The categorized unknown information, the uncertainties, is the realm of predictions. Specifically, the actual uncertainties are genuinely indeterminable and encompass components such as future interest rates, innovation rates, and other market fluctuations. Thus, scenario planning is as much an art form as a science. Probabilities notwithstanding, scenario planning depends on blending the two categories into a finite set of internally consistent and valid views or forecasts describing many possibilities.

References:

Koehler, D. J., & Harvey, N. (Eds.). (2004). Blackwell handbook of judgment and decision making (1st ed). Blackwell Pub.

Leave a comment